Production of local medicine raw materials, better known as active pharmaceutical ingredients (API), holds huge forex-earning potential but faces a host of headwinds from within, industry-insiders have said. They say the emerging sector has been facing lack of sufficient investment, including bank finance, at a time when it can spread …

Read More »Top Post

Sales of ACs, electric fans heat up

Demand for air conditioners, electric fans and rechargeable fans in the capital Dhaka has surged amid a sizzling hot summer in the country. According to the Bangladesh Meteorological Department, temperature in the capital rose to a 58-year record high to hit 40.6°C on Sunday. Dhaka was one of the 13 …

Read More »-

Steel manufacturers suffer from skyrocketing operational costs

The country’s steel sector experienced a 65% jump in operational cost in the last one …

Read More » -

State Minister: RMG workers will get salary, bonus before Eid

-

Prottoy Scheme launched under universal pension system

-

BB to start exchange of new notes from 31 March

-

Excess liquidity in banks dips in Jan

-

Will PRAN Smartphones Attract The Young?

PRAN–RFL group which announced venturing into the highly-competitive handset market early this year, is set …

Read More » -

Is Bangladesh A Testing Ground For De-Dollarisation?

-

Tumultuous Politics Turning Confrontational

-

Electronics Makers Dream On

-

DSE, CSE continue losing streak

Recent Posts

Steel manufacturers suffer from skyrocketing operational costs

The country’s steel sector experienced a 65% jump in operational cost in the last one …

Read More »State Minister: RMG workers will get salary, bonus before Eid

State Minister for Labour and Employment Md Nazrul Islam Chowdhury on Tuesday said a decision …

Read More »Prottoy Scheme launched under universal pension system

The government on Wednesday introduced a new scheme named “Prottoy” under the Universal Pension Scheme …

Read More »BB to start exchange of new notes from 31 March

On the occasion of holy Eid-ul-Fitr, Bangladesh Bank (BB) will start releasing new notes in …

Read More »Excess liquidity in banks dips in Jan

The excess liquidity in the country’s banking sector saw a decrease, falling by 5.38 per …

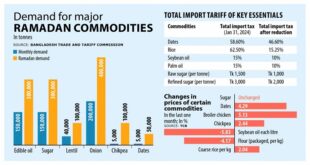

Read More »Govt to buy 8,000 tonnes of lentil, 10,000 tonnes of sugar

The government has decided to buy 8,000 tonnes of lentil at Tk 76.64 crore and …

Read More »Shrimp exports to face significant competition after LDC graduation

Shrimps, popularly referred to as “white gold” due to being one of Bangladesh’s most valuable …

Read More »ADP spending in Jul-Feb 14-year low

Spending under the annual development programme (ADP) has been going slow in the current fiscal …

Read More »Why do high prices persist despite govt steps?

Exorbitant prices! Unbearable!! These are among the words that have dominated public discussions in Bangladesh …

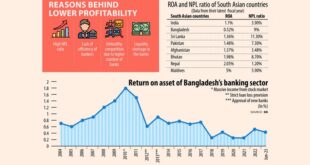

Read More »Bangladeshi banks’ profitability lowest in South Asia

The profitability of the banking sector in Bangladesh is the lowest in South Asia due …

Read More »Brac Bank, BB to support women and agri entrepreneurs

Brac Bank has signed a participation agreement with Bangladesh Bank to avail Credit Guarantee facility …

Read More »Survey: 64% believe capital market is manipulated

A total of 64% respondents from a recent survey believed that fraudulence or market manipulation …

Read More »Report: RMG buyers must commit to minimum wages

In a recent report by the Fair Labor Association (FLA), they said buyers must commit …

Read More »Respite for consumers as onion price decreases by half

The prices of onions have seen a significant decline in different regions of the country …

Read More »Experts against withdrawal of tax benefit on remittances

Amid ongoing efforts to bolster foreign currency reserves and stimulate remittance inflow into the country, …

Read More »Securing the nation, farmers themselves are vulnerable

Despite their tireless efforts to ensure food securities for the nation, farmers themselves are among …

Read More »Banks can’t impose any fine on supervision charges: BB

Bangladesh Bank (BB) today directed banks to refrain from imposing any fine or interest on …

Read More »US trade body urges govt to end detention of RMG workers

The American Apparel and Footwear Association (AAFA) has urged Bangladesh to end the detention of …

Read More »Bangladesh’s exports to keep boosting economic growth: BMI

Bangladesh’s exports will continue to contribute to its economic growth in the short term although …

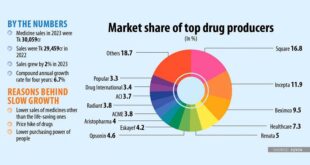

Read More »Profits of listed pharmaceutical companies in Bangladesh shrank

Despite the price hike, sales of medicines in Bangladesh grew at the slowest pace in …

Read More »Per capita income jumps 23.24% by $643 in five years

Per capita income of Bangladesh has increased by $643 to $2,765 in the last five …

Read More »Food insecurity grips Bangladesh

A staggering nearly 22% of Bangladesh’s total households are grappling with moderate or severe food …

Read More »‘Diversify export products, skill up workers to navigate economic challenges’

Stakeholders including experts on industries and economists underscored the need for diversifying export products to …

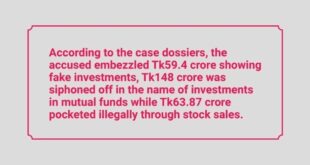

Read More »ACC sues 24 individuals, including former ICB MD

The Anti-Corruption Commission (ACC) has filed a lawsuit against 24 individuals, including a former managing …

Read More »Lending rate surges to 11.89% in Jan 2024

Interest rate against borrowing from banks has surged to 11.89% as the Bangladesh Bank raised …

Read More »22pc of households facing moderate food insecurity while 0.83pc severe: BBS report

About 21.91 per cent of Bangladeshi households are facing moderate food insecurity while 0.83 per …

Read More »Shipping giant Maersk said on Sunday it was suspending the passage of vessels through a …

Read More »From bleak to better

Bangladesh’s economy was beset by enormous challenges in 2023, including soaring inflation and depleting forex …

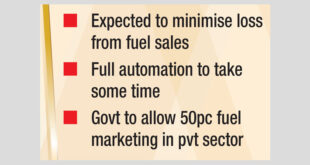

Read More »Automated fuel pricing from this month

In a significant move towards aligning domestic fuel prices with international benchmarks, the government is …

Read More »API can earn billions if barriers broken

Production of local medicine raw materials, better known as active pharmaceutical ingredients (API), holds huge …

Read More » Welcome to Business Outlook

Welcome to Business Outlook