Bangladesh’s exports will continue to contribute to its economic growth in the short term although high inflation, a weaker taka, and restrictions on imports will weigh down consumption and private investment, according to a new report.

The report, prepared by BMI, a provider of insights, data and analytics owned by Fitch Solutions, said a weak macroeconomic environment and lower purchasing power had caused consumers to shift spending away from mid-priced clothing towards low-priced items, benefitting low-wage producers such as Bangladesh. The report was released last week.

“We expect that Bangladesh’s exports will be bolstered by the growth of low-priced clothing sales across key destinations.”

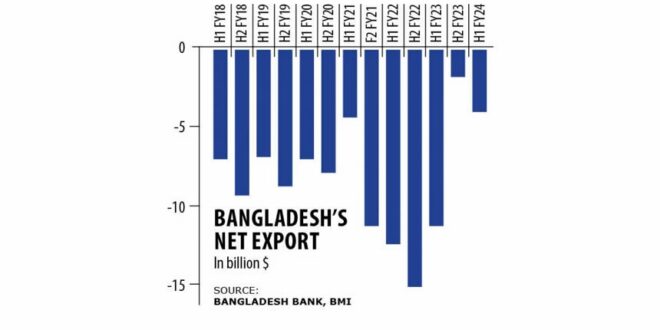

According to BMI, Bangladesh’s net exports, which have historically been in the negative, improved to $3.9 billion in the negative, significantly higher than the average net exports of negative $8.1 billion since FY2017-18.

“Net exports are a bright spot as Bangladesh’s trade deficit has decreased over recent months and stands at a low, even compared to pre-pandemic levels.”

Net exports bottomed out at negative $15.1 billion in the second half of 2021-22, it said.

“The devaluation of the Bangladeshi taka will sustain the country’s export competitiveness and keep net export growth elevated.”

BMI said Bangladesh’s economy is projected to grow 5.4 percent year on year in 2023-24, which is lower than the Bangladesh Bureau of Statistics (BBS) estimate of 5.78 percent.

BMI’s prediction is also lower than the forecasts made by the World Bank and the International Monetary Fund.

In January, the World Bank projected that Bangladesh’s gross domestic product would slow to 5.6 percent in FY24. The IMF forecast a GDP growth of 6 percent.

This ranges below the robust pre-Covid growth rates, which averaged 6.6 percent in the decade to the pandemic, BMI added.

According to the data service provider, higher inflation and interest rates, capital goods import restrictions, a weaker taka and the ongoing shortage of foreign currency will weigh heavily on private sector investment.

“Although we do not currently forecast the taka to undergo significant further depreciation in the short term, the strong devaluation of the currency in 2022 will continue to weigh on household purchasing power.”

Inflation is forecast to average 9.4 percent in FY24, up from 8.9 percent the previous year and considerably above the historical five-year average of 6.3 percent from 2018-19 to 2022-23.

“We forecast private consumption to continue under-performing as high inflation undermines household purchasing power.”

It also forecast that private consumption would expand by 6 percent year on year in FY24. But the growth is lower than the stronger growth rates of 8 percent and 7.5 percent recorded in 2020-21 and 2021-22, respectively.

However, it said, robust remittance inflows will provide some upside pressure to consumption.

Remittances inflows, which amount to roughly 5 percent of Bangladesh’s GDP, have grown at an average of 22.8 percent per month since October 2023, it said.

“We expect inflows to remain strong, supported by a positive economic outlook for the Gulf Cooperation Council economies,” said BMI, forecasting the bloc’s economic growth would accelerate from 0.7 percent in 2023 to 2.6 percent in 2024.

An increase in energy prices due to a regionalisation of the Israel-Hamas war poses a key downside risk to the outlook, it said.

BMI added that although energy prices have declined since their rise in response to Russia’s invasion of Ukraine, they are expected to remain comparatively high.

(TDS)

Welcome to Business Outlook

Welcome to Business Outlook