Exorbitant prices! Unbearable!!

These are among the words that have dominated public discussions in Bangladesh in the past two years. And the discontent of a majority of the population is growing since they are not getting any relief from higher inflation.

Inflation, in general, has stayed at an elevated level since the middle of 2022 and at more than 9 percent since March 2023, in particular.

Consumers were not spared even during the fasting month of Ramadan, a time to show self-restraint, even though there have been a lot of promises and drives on the part of the government. Therefore, while devotees perform their religious duty, the escalated prices of essentials have continued to give them hard times.

Take the case of chickpeas.

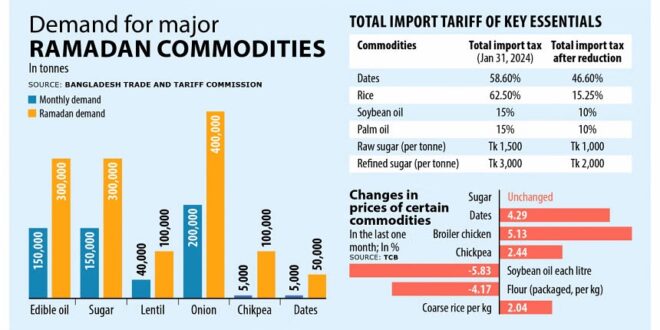

The price of the nutritious seeds, imported mostly, rose 13.5 percent over the last two months and 23.5 percent in the first nine days of the fasting month, which alone accounts for one-third of the total annual consumption of 1.5 lakh tonnes of chickpeas.

The price of dates, another popular item for iftar, rose too. Sugar, a major item used to make sweets especially popular jalebi, has remained steady. Consumers received some respite while purchasing edible oil. The price of the imported fruits declined marginally.

But consumers are yet to see any reduction in the prices of rice, moong and other pulses and broiler chicken.

These essentials have rather become dearer though there had been a lot of efforts to contain prices: the government sat with traders, reduced import taxes and VAT, conducted drives against price manipulation and hoarding, launched open market sales, and fixed prices of essentials.

Thus, it begs the question what is wrong with the market? Why aren’t the prices falling?

The Daily Star spoke to consumers’ rights groups, industry operators and analysts to know why markets are behaving irrationally.

One common observation was the discrepancy between supply and demand. This means without guaranteeing adequate supply based on proper assessment of demand and active monitoring, price control measures are not going to bear fruit.

Another point, as some traders said, is the hidden costs that include unofficial payments made to banks to buy US dollars while opening letters of credit (LCs) for imports owing to limits enforced by the central bank to discourage non-essential purchases from the international market.

“It is not possible to implement the prices of commodities in the way the government has set,” said MA Taslim, professor of economics at the Independent University, Bangladesh.

He said the government can make a lot of commitments and set the prices but the market has its own pattern.

“If the government’s data was correct, the current situation would not have arisen.”

Taslim, who taught economics at the University of Dhaka and headed the Bangladesh Trade and Tariff Commission as its chairman previously, said that there is supply shortage. Therefore, the prices of the products have gone up.

He, however, says it is unclear to him why traders are not ramping up the supply despite knowing that demand goes up in Ramadan.

“They know they can make a good profit. Still, they are not supplying an adequate volume of goods to the market. An in-depth investigation is required to identify the issues.”

Prof Taslim calls for setting up a neutral body that will furnish the government with accurate information on demand and supply.

Consumers Association of Bangladesh President Ghulam Rahman says the fixation of prices by the government contradicts the state’s free market economy policy since prices are determined based on the supply and demand in such an economic system.

The former chairman of the Anti-Corruption Commission and commerce secretary urged the government to examine the authenticity of the data that acted as the basis for the price ceiling.

“If data and methods are realistic, the price fixation will be effective.”

However, he says the government’s role does not end just by capping the prices. Rather, it should also ensure that the prices are followed.

“And this can be possible by giving a boost to supply.”

The former bureaucrat expresses his doubts whether raids by state agencies aimed at reining in prices will work in a country with millions of vendors.

AHM Shafiquzzaman, director-general of the Directorate of National Consumers Right Protection, thinks the prices of some products declined as a result of regular drives.

He says higher import costs stemming from the dearer US dollars and an elevated level of customs duties have an adverse effect on the price level.

However, these two factors alone don’t explain the exorbitant prices being charged.

Traders’ profiteering tendency to take advantage of the situation is another reason, Shafiquzzaman said.

Taslim Shahriar, deputy general manager of Meghna Group of Industries, one of the biggest commodity importers and processors in Bangladesh, said the price of imported goods goes up by 30 percent automatically owing to the depreciation of the taka despite the stability in the global commodity market.

Alongside, he said, there are other expenditures including transport and labour costs.

Shahriar said currently consumers can buy edible oil at prices that are lower than the previous year. For example, the price of soybean oil was Tk 205 per litre in 2023 whereas processors are selling them at Tk 157.

“This is because the price in the international market has dropped.”

Since sugar has become costlier in the global market, consumers would have to pay more for the sweetener, he said.

A cheaper US currency and reduced imported tariffs could enable importers and processors to cut the price of both soybean and sugar, he said.

A number of traders claim that many importers are showing lower import costs through under-invoicing to evade taxes by taking advantage of the complexity related to LCs.

They pointed out that only half of the actual import costs are being declared while buying items such as dates, chickpeas, peas, and lentils.

Mahbubul Alam, president of the Federation of Bangladesh Chambers of Commerce and Industry, said banks are still not adhering to the dollar rate set by the Bangladesh Foreign Exchange Dealer’s Association and the Association of Bankers, Bangladesh.

The exchange rate has been set at Tk 110 but banks are settling LCs at Tk 118 to Tk 122, he alleged, adding while determining the prices of imported goods, the agreed exchange rate is taken into account.

He said the actual cost remains unknown due to the under-invoicing and most of the 29 products whose prices have been capped are not being sold at the rates.

Abul Bashar Chowdhury, chairman of the Chittagong-based BSM Group, a commodity importer, said consumers will be able to buy commodities at reduced rates if prices drop in the global market and their supply increases in the domestic market.

He said clients’ relationship with banks determines whether the former would get the scope to open LCs.

“This means there has not been a level-playing field for all traders and an unhealthy competition has been created in the market,” he said, adding that there is a tendency among traders to make an extra profit.

Protik Dutta, an executive magistrate under the Chattogram district administration, told The Daily Star that several teams are conducting daily raids in various markets of the port city on the occasion of Ramadan.

He said many traders are found to be making excessive profits.

“For instance, we visited an importer’s warehouse with import information from customs. We cross-checked the data with sales receipts and found that profits were more than double the import cost.”

(TDS)

Welcome to Business Outlook

Welcome to Business Outlook